Narrator: Welcome to Blockchain Explained, a podcast about opportunities, challenges, and trends in blockchain technology. Whether you're a beginner or an expert, a developer or just crypto-curious, this podcast is for you. It features industry leaders and government officials discussing the world of distributed ledgers, cryptocurrencies, and the metaverse. And now, here are your hosts, Alan Rechtschaffen and Kellee Wicker.

Kellee Wicker: Hello and welcome back to get another episode of Blockchain Explained. I'm your host, Kelly Wicker joined by my lovely cohost, Alan Rechtschaffen. We're joined today by a really exciting guest, Crypto dad, former chairman J. Christopher Giancarlo, who was the Chairman of the CFTC. He's now senior counsel at the law firm, Wilkie foreign Gallagher and the co-founder of the Digital Dollar Project. I want to save a lot of time with this conversation. So I'm going to hand it off to Alan so we can jump straight in.

Alan Rechtschaffen: No, Kellee, I always appreciate being your lovely co-host and it is an honor to have you here, Chris. Chris and I have become friends, but somebody I've been looking up to for many, many years, and you're all the CFTC as a professor in the area of financial markets and focusing on derivatives my entire career, seeing what you did at the CFTC and seeing the way that you are evolving regulation and the way people think about regulation in the context of technological innovation has really been an inspiration. And I really want to talk brass tacks because here we are November 20th, about two weeks after the election. The president is going to be Donald Trump, second administration. And I think that there is a perception in the world that things have changed dramatically. I would like to focus that perception on the blockchain and specifically cryptocurrency markets. And blockchain is a technology and we've got, we often have Peter Howson who talk about the technology of blockchain. For this conversation, I would like to focus on one application of blockchain, which is that of cryptocurrency. And I want to understand from you, how did the world actually change on November 5th when Donald Trump became the president of the United States?

Chris Giancarlo: Thanks, Alan. And by the way, it's delight to be with you and Kellee, thank you so much. The world did really change. Now, you we know the headline facts, you might say it was a fourfecta, more than a trifecta, it was a fourfecta to win for Trump, both Houses of Congress and not only an electoral college victory, but a popular vote victory. But more than a victory, it was really a political realignment with his ability to make inroads into groups that historically have voted for the other party amongst minority groups, amongst young people, amongst many coalitions that formerly. I mentioned those because they're actually very important for the sea change that's happened in the very area you mentioned, which is in crypto. The Biden administration policy, both stated and unstated, was really hostility to downright suppression of crypto, from discouraging banks from lending to this new innovation, from discouraging Congress, from passing legislation, from discouraging regulatory heads to passing rules and pathways for this innovation to become regulated. It's telling that the only regulatory framework put in place for crypto here in the United States was actually done during the first Trump administration during my time at the CFTC when we green-lighted Bitcoin futures. For the last four years, the official and unofficial Biden policy has been resistance. What's changed is that policy is now ended and will be ended firmly with the Trump administration that not only has gave an important speech in Nashville laying out a whole series of undertakings and promises to this industry, but is putting in place leaders who will effectuate those promises. And so we're going to go from a policy of hostility to a government wide policy of acceptance, of receptivity and encouragement of this innovation. Trump has said he wants to make the United States the crypto capital of the world. Well, there are a lot of people planning on holding him to that promise. And many of those were the young people and the minority groups that formed part of his coalition. So we've got a mandate. We've got a a governing ability now with the two House of Congress. We've got people being put in place that are going to further innovation. And we've got a whole series of promises to be kept by this administration. I think we truly are going to go into just a booming area for this innovation. And I was just overseas meeting with overseas regulators and they're telling me they fully expect their innovators now to migrate back to the United States having fled abroad for the last four years.

Kellee Wicker: Can I actually chime in on that one? I know for a long time we've been hearing from people on this podcast that all the industry wants is just clarity. They also want it to be favorable clarity, just clarity, understanding where we stand as a government. How quickly, you you mentioned people are looking at coming back already. How quickly do you think we will see some of that clarity emerge? How quickly can this get done?

Chris Giancarlo: So Europe has a governing philosophy that says when there's a new innovation, regulators pop on the scene early, tell the innovators, stop innovating, we're going to write rules and once our rules are in place, commence your innovation. And what happens is then the innovators innovate to solve the regulatory rule set, not to actually solve social or commercial issues. It's one of the reasons why Europe has been less successful in terms of technology innovation. We in the United States approach it the opposite way. We often wait for the innovation to develop. Take the internet, for example, in the 1990s, we had a do no harm policy. We didn't write a lot of rules. We allowed the innovation to come about. And by the time we figure out what public policy needs, we write the rules later. I think a similar thing needs to take place here. You know, when it comes to certain things like stable coins, we've now seen them and they're starting to mature. We can know what our public policy is. We can write rules around it. In other areas, we just need to end the debanking. The Biden administration told banks, do not finance this innovation. Once we allow it to be financed, once we allow the regulatory bodies to put the basic rules in place, we can allow this innovation to flourish and then we'll know what public policy needs. Now, as a former regulator, there's going to be fraud, there's going to be manipulation, and it's the job of government to crack down on that. So we will need rules, we will need regulation, but we've got to get the balance right. We can't do it too fast, too soon. We can't do it too late. But let's just stop the hostility so it can flourish, and then we'll really know where the public policy necessary rule sets will be.

Alan Rechtschaffen: So my dad always used to say that, how do you eat an elephant? And the answer was one bite at a time. This is a big thing. And I'd like to break this down into three categories, if we could. You've got monetary and fiscal policy as one category. You've got private cryptocurrency, which maybe is related to the first. And you've got technology. And maybe all three of these are interrelated. And I'd love to hear your thoughts on each of these three categories. One of the things that the president said at the speech you're referring to in Nashville is the idea of having Bitcoin as part of the reserve. He talked about having a commission on cryptocurrency or on blockchain. I don't think it's fully defined. So I'd love for you to break down the monetary and fiscal policy aspects of this, the private cryptocurrency initiative aspects of this, and then ultimately the technology and how that relates to this with the bringing people over beyond the financial sector.

Chris Giancarlo: Throughout most of human history, on the first one, monetary policy, throughout most of human history, every nation's sovereign currency was primarily tied to some type of organic commodity. Mostly that was precious metals, gold and silver. But one might even argue that for the latter half of the 20th century, after the United States went off the gold standard, the dollar still remained backed by a physical commodity and that was oil. One of the checks on monetary profligacy or debasement of one's currency is the use of a stabilizing factor in the form of a limited source commodity. The reason why we stabilize money with gold and silver is because there's only so much can come out of the ground at any given time and it prevented debasement of the currency. Well, today we've seen major debasement of the US dollar. How foreign of an idea is it to think that in a digital future, we may once again base our currencies on a commodity, but this time a digital commodity, one that has programmed scarcity built into it, such as Bitcoin. it's not such a far-fetched idea because countries like the BRICS nations are already experimenting with that idea. And China has been talking about it with their own digital commodity. The notion of a digital, of a stockpile, and I would ask the question, does it need to be limited to Bitcoin? Maybe it might be limited to other digital commodities like Ethereum, like XRP or others, but we can explore that. But I think the notion of a stockpile makes a lot of sense. In fact, nations like the United States, nations like China, stockpile commodities all the time. We stockpile petroleum. China stockpiles soybeans. They stockpile rebar. They stockpile copper. Commodities are stockpiled by nations all the time. And we should be, and President Trump is absolutely right to be thinking about a stockpile of digital commodities. And we're absolutely right to be thinking about, I'll give you one other factor. I don't have the exact numbers, but back in 2018, the average price of a home in the United States was something like $240,000. And that would have cost you something like 200 or 300 Bitcoin. Today, the average price of a home in America is $460,000 something dollars, and that will cost you, what, five Bitcoin. Pretty amazing when you think about how a digital commodity has been able to maintain, in fact, enhance its value, while unfortunately our dollar, which we've done so much printing over the last few years, has lost its value. So we may get to a point where we may need that digital commodity like a Bitcoin or others to once again stabilize the dollar to protect its monetary value.

Alan Rechtschaffen: And would you think that this would... Are we talking about a global change, a seismic shift away from a fractional reserve system? Or is this going to operate hand-in-hand with a fractional reserve system?

Chris Giancarlo: I think it's going to operate. The 20th century, money in the 20th century is relatively easy to understand, at least after the first half. The dollar was king. The dollar had a relatively stable value. The dollar was the currency that nations need to use to price goods and services to buy basic commodities. I think the 21st century is going to be very, very, very different. The 21st century is going to be a series of competing digital networks of value. Some of those are going to be decentralized like Bitcoin with no central operator, but tens of thousands, if not millions of people operating nodes in the system. Other systems are going to be highly centralized. Some of them run by nation states like China with its digital yuan and Europe with its digital euro. And some centralized and run by private sector big tech companies like PayPal or Circle. And others are going to be fractionalized deposits or digitized digital accounts at financial institutions, tokenized deposits. And some are going to be operated by states. I think I heard this morning that Florida is toying with the idea of a digital Florida coin that will be legal tender in Florida. And I don't know whether that passes constitutional muster, but we're going into a very different 21st century world, that's not gonna be the kind of unified world of the 20th century, unified around the dollar. And we're going to have to ask ourselves some key questions. How do we future proof the dollar for this world? How do we preserve its reserve currency status if we can? And most importantly, how do we preserve the values that the dollar has traditionally stood for? The values of free trade, free enterprise, and most importantly, freedom to engage in commerce free of government surveillance and government censorship. That's not the design of the digital yuan, by the way. That design is a very different design based on state control and state surveillance. The digital euro is not fully accordance with US constitutional principles either, not that it should, but there is a degree of surveillance built into that as well. And so, if the 21st century is going to reflect the values that the world enjoyed in the 20th century, the values that America brought to the world, we've got to get to the work right now, the hard work of future-proofing the dollar for this very different world of very, very different systems of value.

Kellee Wicker: I'm interested to know, you know, there's a lot of people that have reservations about cryptocurrency as a financial instrument, whether it be businesses or individuals. What are some of the key concerns you hear and, and how do we address those?

Chris Giancarlo: Well, concerns I always focus on are the ones I just mentioned, values. But there's many others. I mean, volatility is mentioned often as a flaw in Bitcoin. I would actually just say it's not a flaw, it's a design feature. Now, not that volatility is good, but why do I say that? Because whenever you have a fixed supply commodity, when demand goes up or down, the only thing that can happen is price action. The reason you have so much price action around Bitcoin is because changing swings in demand. So it's not a design bug. It's actually, built into the design of it. What makes Bitcoin so relative to a currency that's being debased like the dollar? I mean, one of every four dollars in circulation today has been created in the last five years. So when you've got a currency actively being debased and then you've got one that's designed like Bitcoin to have a fixed amount, that's why you see the differential. That's why a new house today will only cost you five Bitcoin. It would have cost you several hundred just five years ago. It's not only that it's growing in value, it's that the dollar is sinking in value, sadly. And this is something that we really need to tackle going forward.

Alan Rechtschaffen: And what does this tell you about private cryptocurrency initiatives? You know, the idea of, we haven't even really gone in the weeds on CBDCs and the global push for that and the privacy issues and all the problems with CBDCs, but what about private cryptocurrency initiatives? Would a government initiative focused on a handful of headline named cryptocurrencies stymie that? Is there an envision that a Florida cryptocurrency could continue to exist in such a regime? How would you see it if you were if you were the cryptocurrency czar of the United States? What would you do?

Chris Giancarlo: Well, I would start by making it clear that whatever we may want, the future is going to be all the above. Americans are going to be dealing with digital current, with CBDC, whether the United States deploys one or not, because Europe's rolling one out. You know, that Miami Ferrari dealership is going to be paying digital euros to import cars for its customers. Americans are going to be dealing with digital euros when they go to Europe. It's not...It wasn't by accident that China loaded into every athlete that came to the Beijing Olympics with a digital wallet and loaded it with digital yuan. Not so much because they wanted them to spend it when they were in Beijing, but so they would take it back to the rest of the world, to the four corners of the globe and see the globe with digital yuan. CBDC is coming whether we deploy one or not. Digital private sector digital currency like stable coins are coming, one of the big achievements of stable coins rarely remarked upon is how they've demonstrated that the global demand for dollars has been largely untapped and unsatisfied by an analog dollar, the demand for dollars is greater than we've been able to satisfy with the dollar in its current form, and that's why dollar-based stable coins have been so successful, and I think they haven't even reached the saturation point around the globe. So the demand for the dollar is tremendous. So the point I want to make is in the 21st century, we're going to have all these different competing systems. I'm less concerned with the difference between private ones and government ones as I am between the values. You know, we have seen in the last four years how big tech is perfectly happy to seize all of our information, make us the customer, and in many cases go into coutts with government to surveil and censor private activity. So there's no reason to believe that they couldn't do the same thing to a private sector stable coin. Just because a stable coin is run by the private sector doesn't mean you've got any greater right to privacy or freedom from surveillance. And that's why the values, whether it's private sector run or public sector run, these democratic American values, we need to prevail. I'll leave you with one other thought. 30 years ago, when the internet rolled out of Silicon Valley across the United States and across the world, it was the United States and other Western country, but mainly the United States, that made sure that the values of the first internet wave were the values of free and open architecture that closed societies could not control for their own purposes. And we did that, not only by the way we architected the internet, but by creating the institutions like ICANN and the Internet Society that maintain those values in the first wave of the internet. Here we are 30 years later, we've got a new wave of the internet, not so much rolling out of Silicon Valley, rolling out of all over the world in terms of building both decentralized and centralized systems of value. But this time around the United States has not heretofore been front and center, insisting that innovation reflect the values of open and free societies or building the institutions that are going to make sure that this wave of an internet of value is one that is safe for freedom and democracy. That's where we need to focus. I'm hoping that a Trump administration goes beyond simple logic like that says, well, CBDC bad, you know, private sector good, but goes to the point that says the values on which we've built. The first wave of the internet should be the same values in which we build this net. And it doesn't matter. Then it won't matter whether it's run by a private sector actor or government sector actor, as long as we insist that the values be ones of open and free commerce, free of either government or big tech surveillance and control. And if we get that right, if we insist that anything that has a dollar associated with it in a digital future is based upon those principles, then the world will continue to flock to dollar-based digital systems of value and flee those closed society systems like a digital yuan and others. If we get the values right, the value will be there. And if we get the values wrong, we'll lose all value in the dollar.

Alan Rechtschaffen: Chris, before you leave us, I wanted to ask you, as we have a new administration entering, Kellee and I have been fortunate enough to be one of the top podcasts with Wilson. We have an audience of legislators, members of the executive, hopefully of the new executive as well, and CEOs and corporate leaders. The President Trump in Tennessee talked about the idea of a cryptocurrency commission, some commission to figure the structure of the regulatory aspects of this out. If you had your druthers or if you could advise the president right now and Congress as to what the structure of a regulatory scheme for cryptocurrency for which considers things like monetary policy, fiscal policy, technology, all these various aspects. Could you tell us what that structure looks like, perhaps in the context of this commission, but maybe going beyond that, how you involve this, you know, our alphabet soup of agencies, SEC, CFTC, the Fed, Treasury, how do you put this all together?

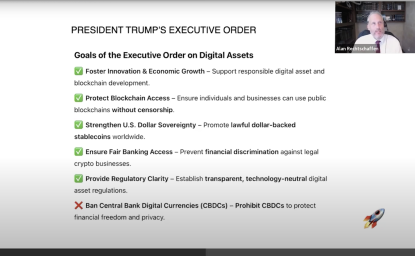

Chris Giancarlo: So we've got to approach this as a whole a government approach. There's work that needs to be done right at the White House. We need an executive order banning the debanking of crypto. We need the SEC to end things like Staff Accounting Bulletin 121, which has prevented banks from appropriately custodying crypto assets. We need the CFTC to reverse its suppression of events, market places based upon tokenization and others so we can move forward in terms of the democratization of events prediction. We need Congress to move forward in the various legislative proposals on stable coins and others. So we need a whole government and I would think that this council could be an advisory body to the White House to get that done. I think most of the president's promises that were made in Nashville can be completed in the first 18 months of its administration if it's well quarterbacked and well coordinated. And then that provides now another two and a half years to focus on the bigger issues of how do we project the dollar into this digital future? How do we protect? You know, there's many global brands, McDonald's and Coca-Cola. I would argue to you the world's most recognized brand is the US dollar, and it's a brand that stands for American values of free enterprise and free trade and free economic expression. We've got to protect that in this future. We should have an explosion of activity. I think that's good. But the one thing that's got to continue to stand for centuries old values is the dollar itself. And I think if the Donald Trump's second administration not only delivered on all these promises for crypto, saw the United States truly turn into the crypto capital of the world, but then took steps to project the dollar to serve three more generations in the global world as the world's reserve currency in a digital 21st century, then I think he will rightly achieve the title of America's and the world's first crypto president.

Kellee Wicker: Chairman Giancarlo, thank you so much for your time today. I know we would love to talk to you for hours. Hopefully we can check in with you next year and see how things are going. We hope all of you will join us for the next episode of Blockchain Explained. It's been great.